Growing businesses to grow the Fund

Monday, July 28 2025 3:31 pm

By Julius Businge Follow on LinkedIn

The Hi-Innovator is a programme that was built in 2020 to improve small businesses that could bring new contributions to the National Social Security Fund(NSSF). Julius Businge speaks to Alex Rumanyika Kalimugogo, the head of Strategy at NSSF, about the programme’s history, success and potential.

What is your name and what do you do at NSSF?

My name is Alex Rumanyika Kalimugogo. I lead the Strategy Department at NSSF. We are responsible for facilitating the strategy process – which simply means we help the key stakeholders like the Board, Executive Management and Staff to design integrated and aligned course of actions to create a different and more impactful future for the Fund from what it is today.

This role involves four major disciplines:

- Strategy development (What is our purpose? How do we create value? Where are we going? How will we get there? What will success look like?).

- Performance Management (Are we on course? How do we correct course? Is everyone playing their part?).

- Project Management (What major initiatives will drive our success? Are we managing them well?).

- Innovation Management (What new opportunities can accelerate our journey? What threats could disrupt our journey? How are we adapting to address these opportunities and threats through a structured innovation process?)

Tell us briefly about the Hi-Innovator programme?

The Hi-Innovator programme was borne out of our innovation process to address the threat that Uganda’s economy is not creating enough jobs. NSSF’s business model is highly dependent on contributions from workers. If the economy is not creating enough jobs, then the long-term sustainability of NSSF as a business is under threat. So, Hi-Innovator sought to work with the entrepreneurship ecosystem of Uganda to stimulate the growth and scale of high impact small-and-growing-businesses (SGBs) that could create new work opportunities and, hence, new contributions to the Fund.

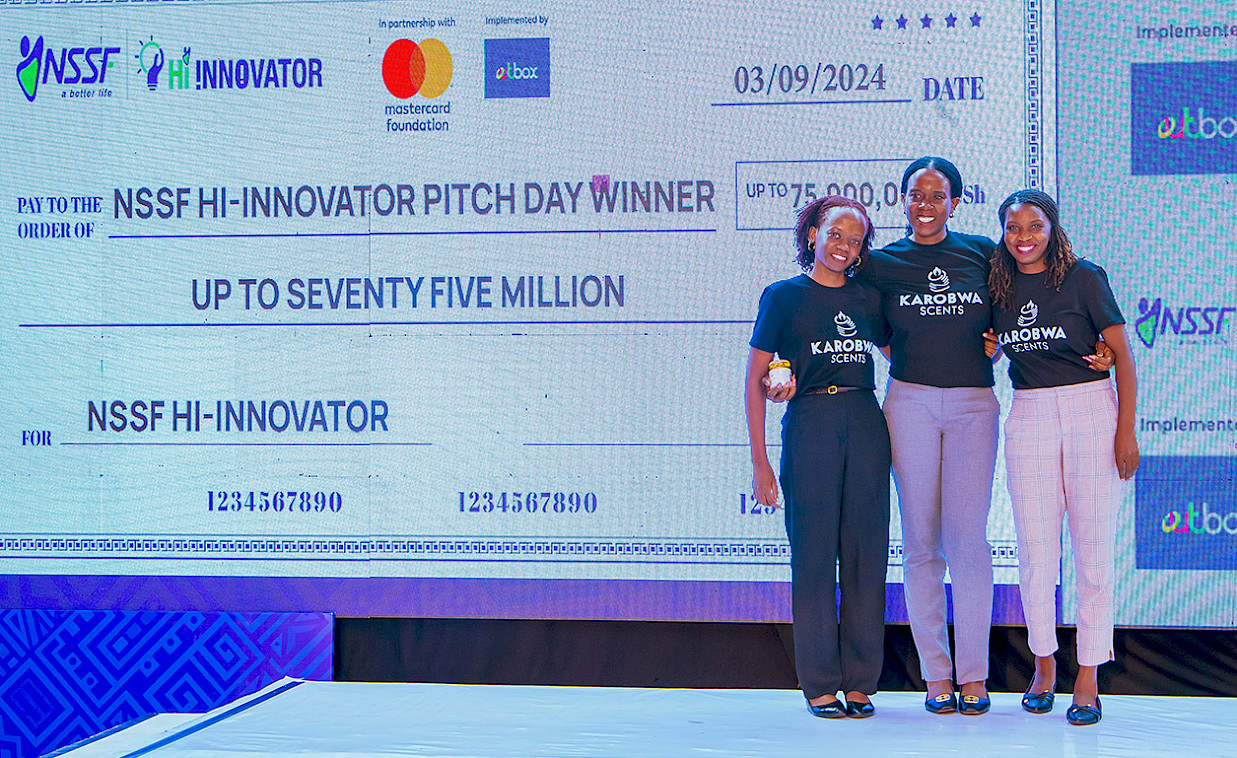

SGBs, as you may appreciate, are considered high-risk because they generally lack stable revenue and cash flows, and mature systems of operations and governance. So, the Hi-Innovator seeks to address these deficiencies and incorporate a seed-funding element to the SGBs that demonstrate the strongest potential for impact, scale, and sustainability. In 2020, we partnered with the Mastercard Foundation, an international philanthropic organisation, to avail USD 10M to seed fund 500 SGBs over 5 years. As the first phase of the programme winds down this year, we have provided USD 20,000 as seed capital to each of the 437 SGBs.

What have been the key milestones of the programme so far?

The programme has had some important milestones along the way. It is worth noting that the programme was launched in the depth of the Covid crisis in 2020. Training of entrepreneurs was one of the objectives of the programme and with limited movement at the time, we had to pivot to build the capabilities to achieve our training objectives. So, we developed an online Business Academy that would enable entrepreneurs to access our content from anywhere and anytime through self-paced learning. To-date, over 81,000 entrepreneurs have gone through our online academy—which is a major milestone for the programme.

The key objective of the Hi-Innovator programme was to create and sustain jobs, which would translate into new members and contributions to the Fund. We therefore made it a requirement for businesses that qualify for funding, to register their employees for NSSF. To date, the 437 SGBs that we funded have secured almost 2,000 new members and net contributions of UGX 1.7B. This is proof that our theory of change is working.

In terms of the total impact of jobs being sustained by the programme—the figure is over 200,000, many of which are jobs linked to the different value chains of the businesses we have funded. Over 50% of these jobs are impacting young people and women, who tend to be the more vulnerable members of our society. This is important because it speaks to the Fund’s vision of making life better for more and more Ugandans.

How did you achieve those impressive results, given how complicated the entrepreneurship landscape is in Uganda?

The model is partner driven. We could not have implemented it without the support of some key partners. Entrepreneurship support is not a core aspect of NSSF’s business model—we acknowledged this from day one. We deliberately looked for institutions that excel in this space to support us with the programme design and implementation. The enterprise support organizations (ESOs) as they are called – led by Outbox Limited – were the most critical pillar of the programme’s success. They helped us coordinate learning in the online academy by mobilising entrepreneurs in their respective communities. They helped us conduct coaching and mentorship exercises as the entrepreneurs prepared to pitch for the seed funding. And they helped us in the due diligence, monitoring, and evaluation processes once entrepreneurs had qualified for the funding. We have worked with 15 ESOs across the country which effort has been majorly coordinated by Outbox.

Besides the ESO structure, internally at NSSF, we had a small, dedicated team to provide general oversight and management of key stakeholders at the Fund and at the Mastercard Foundation.

It is said that many businesses in Uganda do not live past their first birthday. Have you observed this in the programme?

The statistic that 70% of small businesses in Uganda do not live past their first birthday is quoted in different circles. Hi-Innovator has defied the odds with an attrition rate of just 3% so far. Although this is impressive, the businesses that went through our programme are lucky to have benefited from a “controlled business environment”. They benefited from business development support in ways that the average business would struggle to access. The learning, the seed-funding and the post-funding support are all elements that most businesses would consider a luxury. Hi-Innovator is proof that entrepreneurship is indeed one of the key factors of economic production. However, without the right incentives and supporting infrastructure, this factor of production is seriously hampered. Since we have proved that it can be fixed, the question we are asking ourselves now is, how can we implement such a programme at a large enough scale to impact the entire economy?

In your experience, how would you describe Uganda’s entrepreneurial landscape?

Uganda’s is a case of a glass half full or half empty, depending on who you ask. Uganda tends to punch above its weight on quite a few global issues—entrepreneurship is one of them. Uganda has attracted over USD 150M in venture capital inflows since 2019. This is impressive. But weigh that against USD 800M that went to Kenya in 2023 alone and you see how the boys are separated from the men. The other large players in Africa are of course Nigeria, South Africa, Egypt, Mauritius and perhaps Ghana. To flourish in this space as a country, several things matter: depth of capital markets, taxation policy, investor protection and governance, human capital and social environment, and entrepreneurship activity level/opportunity. Uganda is certainly making good progress in all but will need much bolder policy moves to support promising start-ups if it is to catch up with the likes of Kenya. NSSF’s role must be commended in signalling this intention because in the region, it is the only Pension Fund that is strategically supporting the ecosystem to shape it as a long-term alternative investment asset class.

What are some of the challenges of working with Ugandan startups?

Uganda is a country of great potential but is still overcoming several structural challenges to fulfill this potential. Many of the challenges we see in the start-ups are structural and systemic. Take for instance the significant investment required to address the country’s infrastructure—energy, transport, internet penetration etc.

Although the government continues to commit significant resources to infrastructure, there is still a huge gap to meet demand. A lot of the produce we see today in the local markets in Kampala is coming from the western regions of Kenya because of the relatively lower cost of transport, potatoes and tomatoes particularly. These are challenges of a structural nature which increase the general cost of doing business. Add to that the interest rates on loans which are high due to perceived risk of lending to business, but also the trade-off associated with lending to Government, where the yields are high. These structural elements significantly elevate the cost of doing business in Uganda, disproportionately so for small businesses.

Then there are “soft” issues. Our society structure and cultural norms encourage informal business operations. This is useful because it helps maintain normalcy in a society with high rates of unemployment. However, as some of our entrepreneurs make in-roads into formalising their businesses, they struggle to let go of habits that make it difficult to access capital and business development support. They struggle to do simple things like keeping good records, giving their employees contracts, filing tax returns, registering their businesses etc.

The learning environment is probably the other issue I would prioritise as a major challenge to address. With a very large youth population, Uganda’s capacity to prepare its youth to compete in the knowledge economy is under strain. It affects the entrepreneurship ecosystem in two major ways. Late exposure of our youth to digital literacy significantly impacts their perspectives of entrepreneurship in terms of the possibilities to solve problems and exploit resources in business. It is no surprise therefore that the default small business in Uganda is typically in some form of trade, most likely attempting to sell a finished imported good. The learning mindset should be one of helping the entrepreneur to create new value by exploiting the environment around him, which digital tools can significantly aid today. The other related challenge is the ability to secure skilled workers as the knowledge economy evolves rapidly. Skills like “machining”, coding, digital and other aspects of value-addition, as well as managerial skills like marketing, finance and people management are not sufficiently available to accelerate the shift we need to be competitive.

What support do entrepreneurs in Uganda need, to attain the success of start ups in Silicon Valley?

The Silicon Valley model demonstrates about 3 elements that are common in successful venture ecosystems globally and not just at Silicon Valley:

- Strong collaboration between learning institutions and enterprise development – the likes of Stanford, MIT and Harvard for example. We see a very deliberate link between Science and Technology and enterprise development.

- Secondly, there is a high concentration of “risk capital” in those ecosystems. This is a unique aspect of American culture that is not as evident in Europe for instance. Ecosystems that are deliberate in pooling capital to fund businesses that are likely to fail is a contrarian concept that flies against logic, and yet a critical aspect of the success equation.

- The third element is about Government’s deliberate efforts to build “magic zones” – that attract creative, smart people to challenge their wits, access resources and network with inspiring people to build purposeful businesses that solve serious problems that potentially have global impact.

Uganda’s national development plan is deliberate about supporting enterprise growth and this is commendable. However, perhaps we are spread too thin. We could start by focusing on a very narrow aspect of science and technology that complements our natural strengths—agriculture green energy, and biotechnology for example—and invest resources to develop a modern enterprise support ecosystem around these pillars. Let’s take our efforts and investment in Kiira motors. Highly commendable. However, Kiira motors should be further established as a major ecosystem for engineering to develop Uganda’s global competitiveness around solar solutions, electric mobility, solar irrigation pumps etc. We import thousands of motorcycles into Uganda every year. A policy to progressively replace these with electric bikes manufactured in Uganda is one way Government can intervene. Kiira motors should already be designing our electric metro service. These kinds of bold policy moves are needed to move Uganda from zero to one at a macro level.

You mentioned earlier that Hi-Innovator created a total of over 200,000 jobs in 5 years. Given the levels of unemployment in Uganda, what would you say is the programme’s secret that could be replicated across other government programmes to solve the job crisis in the country?

Uganda’s strategy to grow the economy tenfold by 2040 signals its intentionality about addressing unemployment via the ATMS strategy – Agro-industrialization, Tourism, Mineral exploitation for industry growth and science-technology-and-innovation. There is not going to be a panacea intervention that will suddenly make unemployment disappear. Hi-Innovator barely touched the tip of a very huge unemployment iceberg. Every year, 700,000 young people join the labour market, but only 90,000 are accessing decent work. If there is anything we can learn from the Hi-Innovator programme, it is that a good policy if well-executed delivers results of high impact. What we need is to identify a few policies of “high leverage” within the “ATMS” and be very ruthless and laser-focused in execution. Ethiopia recently set a goal of having 500,000 electric vehicles (EVs) on the road by 2030. Aligned to this goal, it passed a few high leverage policies like banning gasoline cars for personal use, duty free import of EVs, support of assembly and sale of local EVs, and investing in EV infrastructure like charging stations. There is short-term pain that a country must face when implementing such a policy, and often we face resistance in facing this pain. With Hi-innovator we did face similar challenges. Investing in small-and-growing-businesses does not offer short term returns to the Fund. It is a long game. Some stakeholders did not immediately buy into this concept. But if you execute well, two out of 10 start-ups could become the next MTN, and boom, you recoup your investment and have 1,000,000 new members. Okay not that dramatically – but you get the point. Focus on a few good strategies that have 3 times potential in terms of impact.

Do you believe empowering young entrepreneurs could be the solution to Uganda’s job crisis?

There is no singular solution to this job crisis as you call it. This must be part of an integrated approach, as the ATMS is indeed structured. We would fit in the last bit. The “S” – Science, technology and innovation—where innovation is really the process and result of taking a great idea to market (where customers can pay for it at scale).

Over and above the Hi-Innovator programme, what opportunities exist for start ups in Uganda?

One good thing that the Government has done is answer this question in its various policy stances. No tax on export of goods for instance. No tax on goods brought in to add value in areas focusing on import substitution. Then there is the policy around economic integration, at a regional level in East Africa, COMESA and continentally with the Africa Continental Free Trade Area. Then there is the strategy of ATMS. If you want to go further, then look at the sustainable development goals (SDGs). So, the Government has done its fair share in “signalling” where the opportunities are. Uganda has significant problems to address which purposeful and focused entrepreneurs can commit their time to. Perishability of food is one quick one that comes to mind. The opportunities are infinite.

What advice would you give startups in Uganda?

Someone said, “Do not take advice from anyone who does not stand to lose anything if the advice is taken”. I am not the best person to advise entrepreneurs about their businesses. Entrepreneurs are special people. They take risks to create value. What we can offer as Hi-Innovator, however, is to ensure our programmes and interventions are transparent, fair, and remain accessible to a large enough population of vulnerable entrepreneurs that would ordinarily struggle to access support and funding from the more traditional institutions. So, if you meet the programme requirements, I encourage you to take that step and join. Particularly women.

Should entrepreneurs who missed this opportunity expect a second phase of the Hi-Innovator programme?

The five-year program has been a very rewarding journey for the Fund and the Mastercard Foundation. The Board of directors of both institutions are interested in implementing a second cycle where they have challenged us significantly to increase its scalability and long-term sustainability and impact. So, as of now, we are in the kitchen cooking Hi-innovator 2.0. We are hopeful that something even more exciting will emerge from this effort. So, yes.

Any parting shots?

One of my favourite authors is Nassim Nicholas Taleb. In his book Skin in the Game he says “Entrepreneurs are heroes in our society. They fail for the rest of us.” Everywhere we look, someone is making ends meet because of an entrepreneur. We all know a relative and friend who, without an entrepreneur, would be struggling in life. Our own President often discusses how the private sector collapsed after the forced exodus of the Asian entrepreneurship community in the 70s. Entrepreneurs are indeed heroes and tend not to be parochial in their perspectives. They set up enterprises to create value not to pursue identity interests. Therefore, if there is one community that we should support wholeheartedly as a pillar of our society’s advancement—it is that of the entrepreneurs!