Economic Drivers and Markets Implications

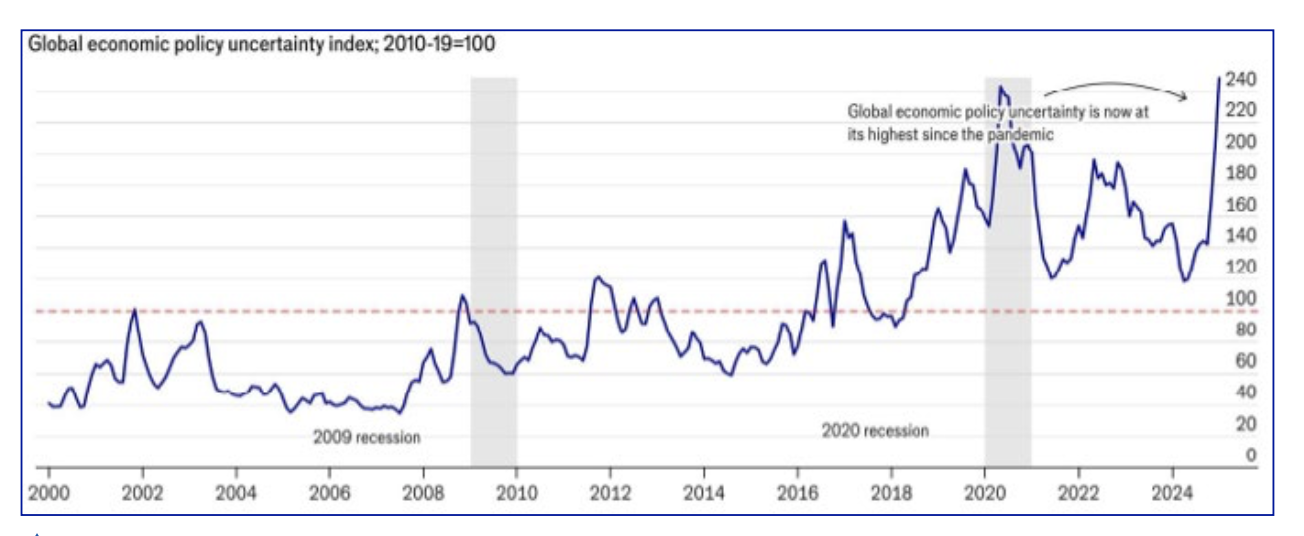

Global Economy: US Trade Policy Coming to the Fore of Global Uncertainty

At the start of 2025, the International Monetary Fund projected global GDP growth would hold steady at 3.3% in 2025 and 2026. More recent insights by economists point to growing downside risks, mainly driven by the escalating trade policy uncertainty under the Trump administration, among other pre-existing factors. The Economic Intelligence Unit (EIU) now projects 2025 global growth at 2.4% while the OECD projects 3.1% growth. The US is expected to grow at 2.7%, fueled by strong demand and policy support. In contrast, the euro area is forecasted to lag at 1.0%, while China will continue to face structural headwinds. Inflation is gradually easing — projected at 4.2% globally in 2025 — but central bank strategies are diverging, with some tightening amid sticky services inflation and a stronger US dollar.

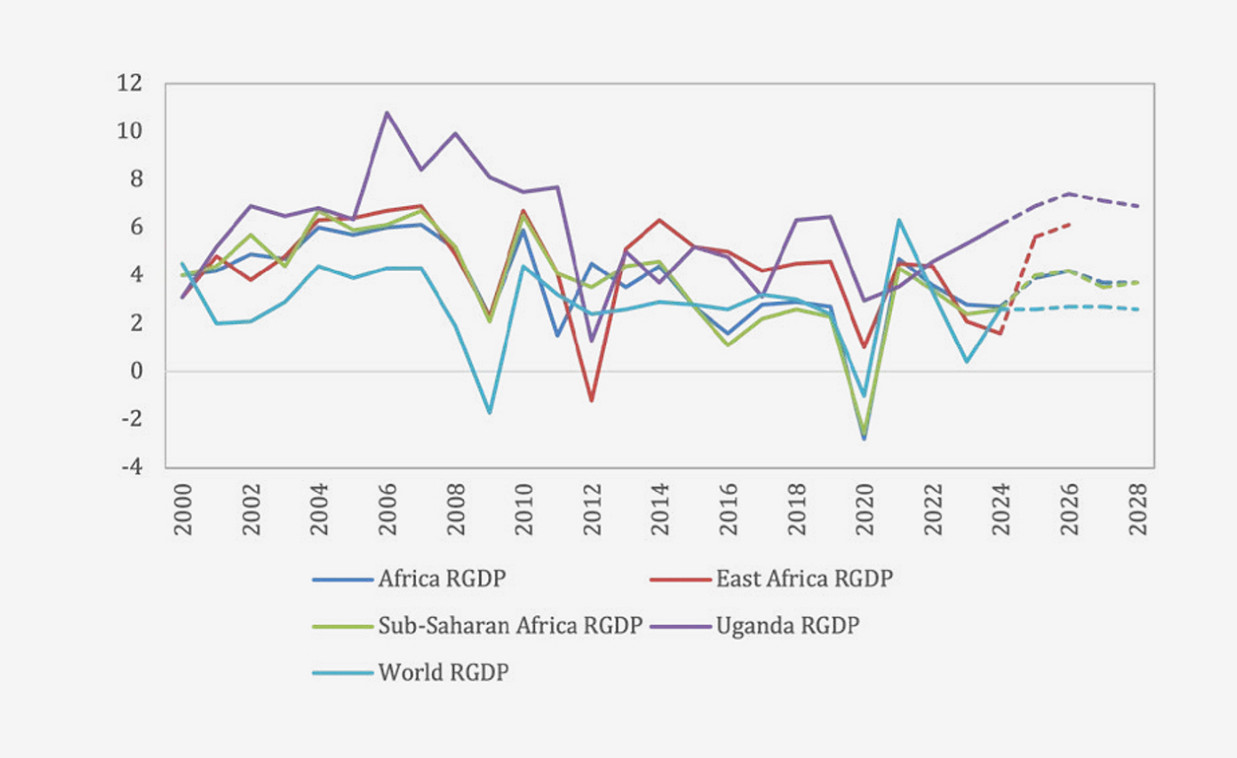

Africa: Stronger Fundamentals amid External Vulnerabilities

Africa’s economic momentum is picking up modestly, with growth forecasted to rise from 3.8% in 2024 to 4.2% in 2025. This improvement is backed by easing inflation, continued infrastructure investment and a rebound in private consumption. Downside risks are likely to emanate from weaker external demand (particularly China and Europe), a stronger US dollar and reduced global liquidity as easing cycles are checked. Fiscal consolidation remains a priority across much of the continent, though public debt remains elevated in several economies.

Inflation trends vary, but the continental average is easing. Countries such as Nigeria and South Africa are benefiting from lower fuel and food prices, although inflation remains elevated in net importers and post-conflict states. Central banks are signalling a more neutral stance, with cautious rate cuts expected in 2025 depending on external conditions.

East Africa: Growth Resilient, but Domestic and External Risks Mount

East Africa remains one of the continent’s fastest-growing regions, with the regional Central Banks projecting 2025 growth above 5% across Kenya, Tanzania, Rwanda, and Uganda. The region is supported by agriculture recovery, infrastructure investment, and an expanding services sector. However, political uncertainty ahead of the 2025 and 2026 general elections in Uganda and Tanzania, respectively, may weigh on investor confidence and tighten fiscal spaces, slowing down expected investments in the region and affecting macroeconomic stability.

Regionally, inflation in Kenya, Uganda and Tanzania remains low and below the central banks’ target ranges but has been slowly ticking up during the first quarter of 2025. The low inflationary environment, however, allowed for a 50-bps policy rate cut in Kenya and holding stances in Uganda and Tanzania during the quarter.

A strong US dollar, driven by still elevated US rates and tariff fears, may, however, keep central banks cautious by limiting monetary flexibility in 2025, amidst rising external debt servicing costs and import bills.

Uganda: Stability and Oil Prospects Drive Optimism

Uganda’s outlook stands out for its strong fundamentals. The country is projected to grow by 6.0% in 2025, supported by ongoing oil sector investments, infrastructure development, strong agriculture performance and a favourable macroeconomic environment anchored by a stable currency and low inflation.

Vulnerabilities are, however, notable with public debt crossing 50% of GDP in FY2024/25, requiring fiscal discipline even as spending demands rise in the face of an upcoming election year and infrastructure investments. Like her regional counterparts, external risks weigh in, particularly with reduced demand from China and potential spillovers from tariff-related trade disruptions.

Implications for Regional Financial Markets and the Fund’s Investment Strategy

Bond Markets: Anchored inflation will continue to provide positive real yields but also allow for lower or stable central bank policy rates. However, the US dollar’s strength and risk-off sentiment may pressure long-term yields upward, especially if fiscal deficits rise during election cycles. Yield curves are therefore likely to steepen further down the year, with front-end support and back-end caution, favouring long-term investment opportunities.

FX Markets: Regional currencies are likely to face depreciation pressure from a strong dollar and tighter global liquidity. While Uganda’s shilling has been more stable, it remains vulnerable to fiscal slippage. Central banks may lean on reserves or limit easing stances to defend currency stability. With likely pressure on currencies, investment in regional currencies may be limited to high alpha opportunities.

Equities: Falling domestic rates may support local equity sentiment, especially in financial and consumption-linked sectors. However, foreign investor flows may remain constrained by low global risk appetite and pre-election uncertainty in 2025, with risks of amplified volatility from shallow market depth. Over the next year, though, foreign exits could create good entry levels in pockets of the market.

Capital Flows: Investors remain selective, with capital favouring economies showing policy consistency and macro stability. Uganda’s oil-driven story may attract selective flows, but execution and election stability will be decisive. ESG and green financing remain promising themes across the region and may provide diversification opportunities.

Africa and East Africa remain resilient growth zones, but global spillovers, tighter financing, and political transitions could narrow fiscal space and test policy agility. Uganda, meanwhile, retains a strong growth trajectory, anchored in domestic investment and macroeconomic stability, but must navigate electoral pressures and rising global uncertainty carefully.

Conclusively, 2025 is not a year of crisis, but one of complexity. Navigating the road ahead will require policy dexterity and external resilience.