Economic Developments and Outlook - Uganda

Monday, July 28 2025 12:42 pm

By Josephine Nakitende Follow on LinkedIn

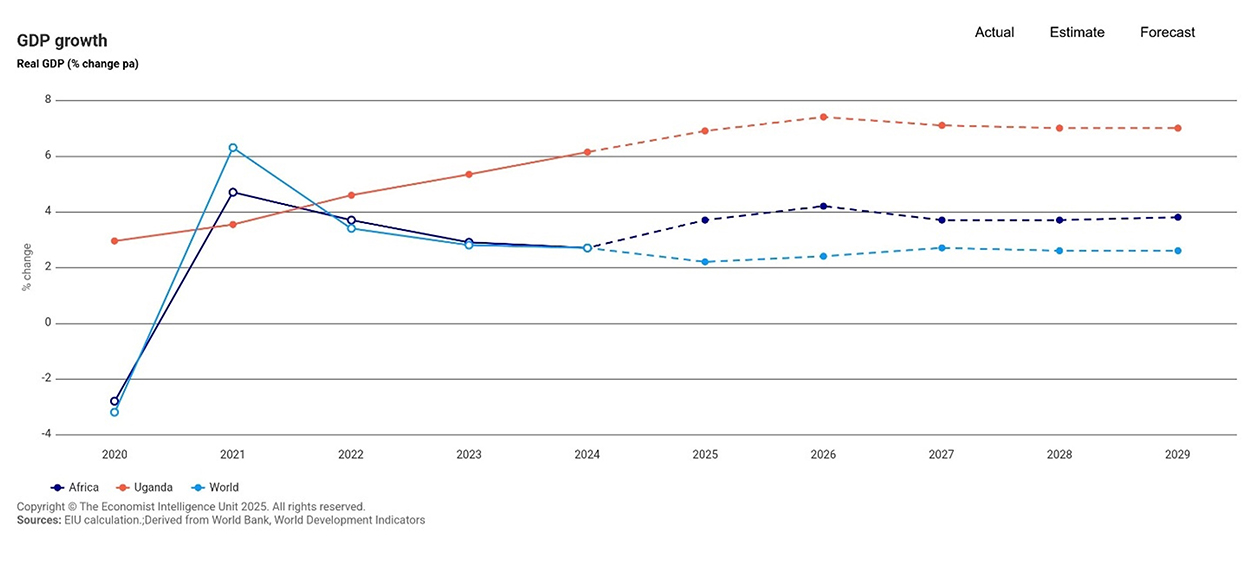

According to the Uganda Bureau of Statistics (UBOS), year-on-year real GDP growth stood at 5.3% in the second quarter of FY2024/25, down from 6.7% in the first quarter, resulting in an average of 6.0% for the first half of the fiscal year. This slowdown was mainly driven by a sharp deceleration in the services sector, which grew by only 2.0% in Q2, compared to 5.6% in Q1. The weaker performance in services outweighed a strong industrial rebound (8.4%, up from 5.9%) and still robust but slightly slower agricultural growth (7.2%, down from 8.7%).

On the expenditure side, the decline was compounded by reduced final consumption, reflecting lower household and government spending, and a widening trade deficit, as import growth outpaced that of exports. While gross fixed capital formation improved to 4.4% from 1.5%, it was not sufficient to offset the weaknesses in other key sectors of the economy.

The Bank of Uganda (BoU) projected GDP growth of 6.0%–6.5% for FY2024/25 and 7.0%–7.5% over the medium term, supported by strategic government initiatives, rising foreign direct investment (FDI) in extractive industries, and the anticipated commencement of oil production in FY2025/26. However, key risks to this outlook include adverse weather conditions, tight global financing, and continued geopolitical uncertainty.

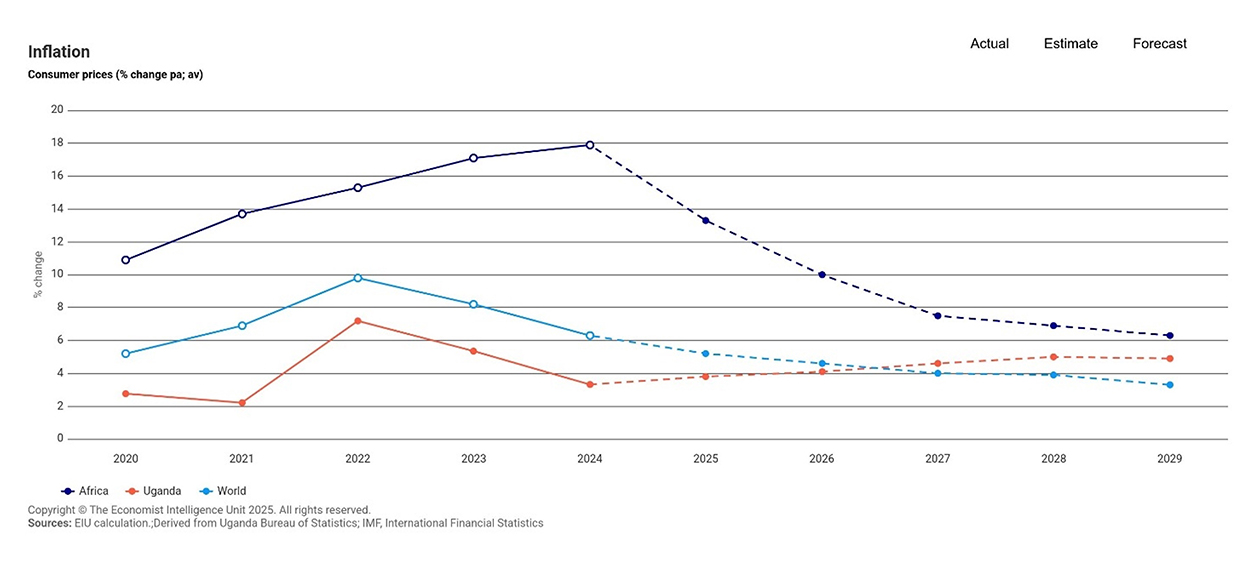

Inflation rose slightly during the quarter but remained below the central bank’s 5% target. Annual headline inflation increased to 3.9% in June 2025, up from 3.8% in May and 3.5% in April, largely driven by higher food crop inflation, which rose to 4.7% from 4.3%. However, core inflation remained steady at 4.2%, supported by stable services inflation at 4.7% in both May and June. According to the Bank of Uganda, the inflation outlook has been slightly revised downward due to lower global oil prices and a stable exchange rate. Core inflation is now projected to average 4.5–5.0% in FY2025/26, gradually aligning with the 5% medium-term target.

The Bank of Uganda (BoU) Monetary Policy Committee (MPC) maintained the Central Bank Rate (CBR) at 9.75% in May 2025, marking the third consecutive hold at this level since October 2024. The Committee said that the decision reflects a balanced approach aimed at anchoring inflation expectations while supporting economic activity amid heightened external uncertainties.

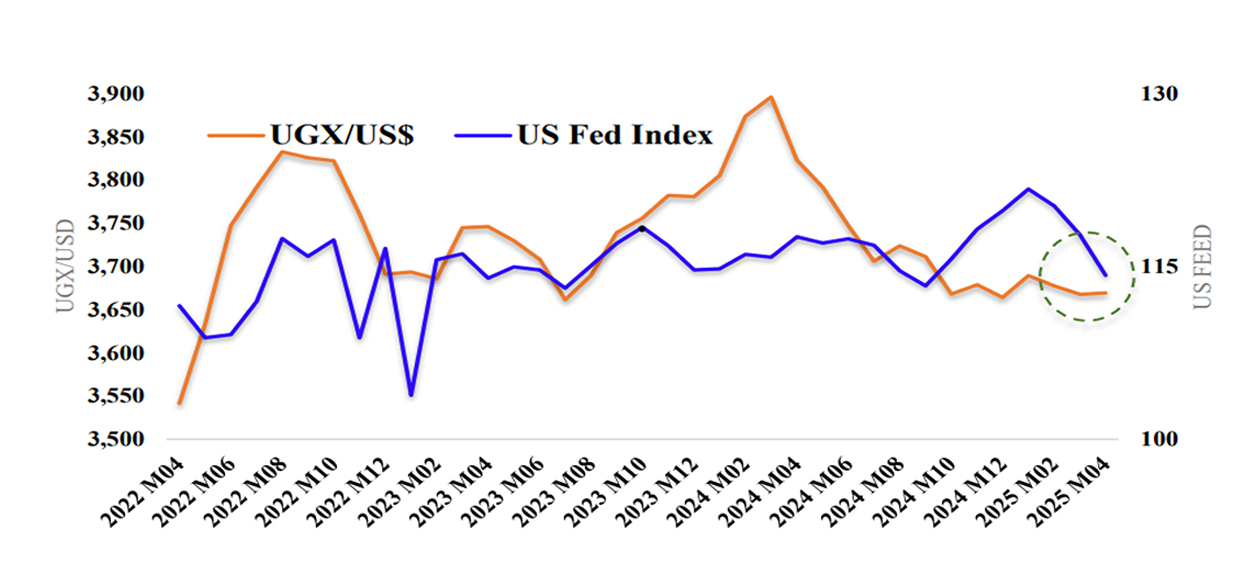

The Uganda Shilling remained stable in June 2025, appreciating by 4.0% year-on-year, 1.8% quarter-on-quarter, and 1.03% month-on-month to an average mid-rate of UGX 3,605.88/USD. This strength is attributed to prudent monetary policy, financial market reforms, and sustained inflows from remittances, NGOs, offshore investors, and coffee exports. The shilling also benefited from the weaker US dollar globally.

However, ongoing global trade tensions may pose risks, potentially increasing exchange rate volatility if uncertainty persists.

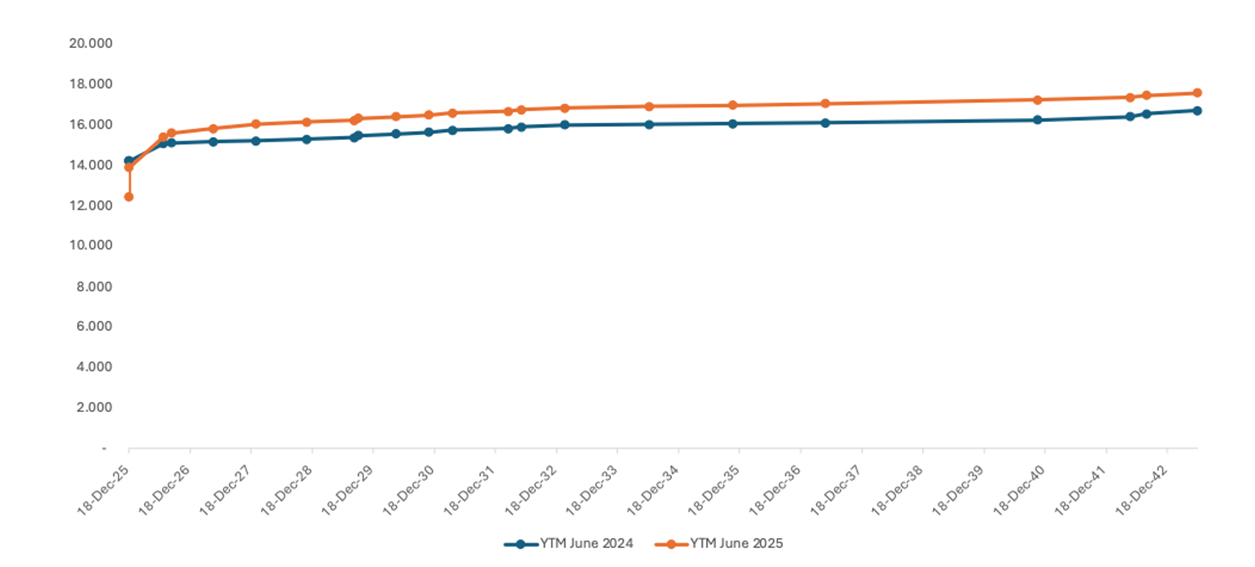

The yield curve steepened during the fiscal year, with long-term rates rising by 100–135 basis points (bps) compared to 20–50 bps for short-term rates. Treasury auctions were oversubscribed, with an average bid-to-offer ratio of 1.98 for treasury bills and 1.62 for bonds. Average bond auction yields increased from 16.0% in June 2024 to 16.88% by the end of the fiscal year, with 10-year and 20-year bonds yielding 17.5% and 17.945%, respectively, in the May 2025 auction. These developments enhanced the relative attractiveness of Ugandan bonds compared to regional peers. The secondary market trade volume rose significantly from UGX 16.81 trillion to UGX 24.31 trillion.

Looking ahead, increased investor appetite for safe-haven assets may drive demand and push rates downward. However, elevated government financing needs ahead of the elections could offset this pressure and keep yields slightly elevated.