Building Wealth in Uganda’s Gig Economy

Monday, May 12 2025 11:22 am

By John Ssenkeezi, Digital Editor Follow on LinkedIn

Uganda’s economy is buzzing with a new energy, much of it powered by the rise of the gig economy. Driven by digital transformation and a growing need for flexible work, more Ugandans than ever are embracing freelance assignments, online tasks, boda boda transport services, artisanal work, and countless other short-term contracts. This shift offers unprecedented freedom and the potential for instant income, attracting many, especially young people, seeking opportunities outside the traditional job market.

However, this flexibility often comes at a price. The very nature of gig work, project-based and dependent on fluctuating demand, means income can be unpredictable. Unlike traditional employees, gig workers typically lack the safety net of employer-sponsored benefits like medical insurance, paid leave, or contributions to the National Social Security Fund (NSSF). This financial uncertainty makes personal savings not just a good idea, but an absolute necessity for handling emergencies and building a foundation for the future.

Fortunately, the same digital wave powering the gig economy also provides the tools to manage its financial challenges. These digital tools can be powerful allies, helping gig workers to consolidate income from various sources, implement effective savings habits, manage budgets, and even access pathways to investment.

Understanding gig finances in Uganda.

Before building a savings strategy, it is crucial to acknowledge the specific financial landscape that Ugandan gig workers navigate. Understanding these realities ensures realistic planning and highlights the urgency of proactive financial management.

The most significant challenge is income volatility. Earnings often fluctuate based on the availability of gigs, seasonal demand, platform algorithms, and intense competition from other workers. This unpredictability makes traditional monthly budgeting extremely difficult. One month might bring a feast, the next a famine, requiring careful management to smooth out these peaks and troughs.

Compounding this is the lack of traditional benefits. Gig workers are typically classified as independent contractors, meaning they miss out on employer contributions to NSSF, medical insurance schemes, and paid time off for sickness. This places the entire burden of saving for retirement, covering medical emergencies, and managing time off squarely on the individual’s shoulders.

Acknowledging these factors is the essential first step. It highlights a fundamental tension: the very instability of gig work creates a profound need for personal savings to act as a buffer against income dips and unexpected costs like healthcare. Yet, the same factors, low or irregular pay and the lack of a safety net, make consistent saving challenging.

Fortunately, Uganda boasts a vibrant digital financial ecosystem that offers powerful tools for managing the complexities of gig income. These tools can help consolidate earnings, track spending, and provide access to essential financial services.

Track Everything:

The first step is understanding where the money comes from and where it goes. This involves diligently tracking all income sources and expenses for a period, perhaps one to three months, using a simple notebook, spreadsheet, or a budgeting app. This exercise reveals spending habits and establishes an average income baseline.

Flexible Budgeting:

Rigid monthly budgets often fail gig workers due to income inconsistency. More adaptable approaches are needed:

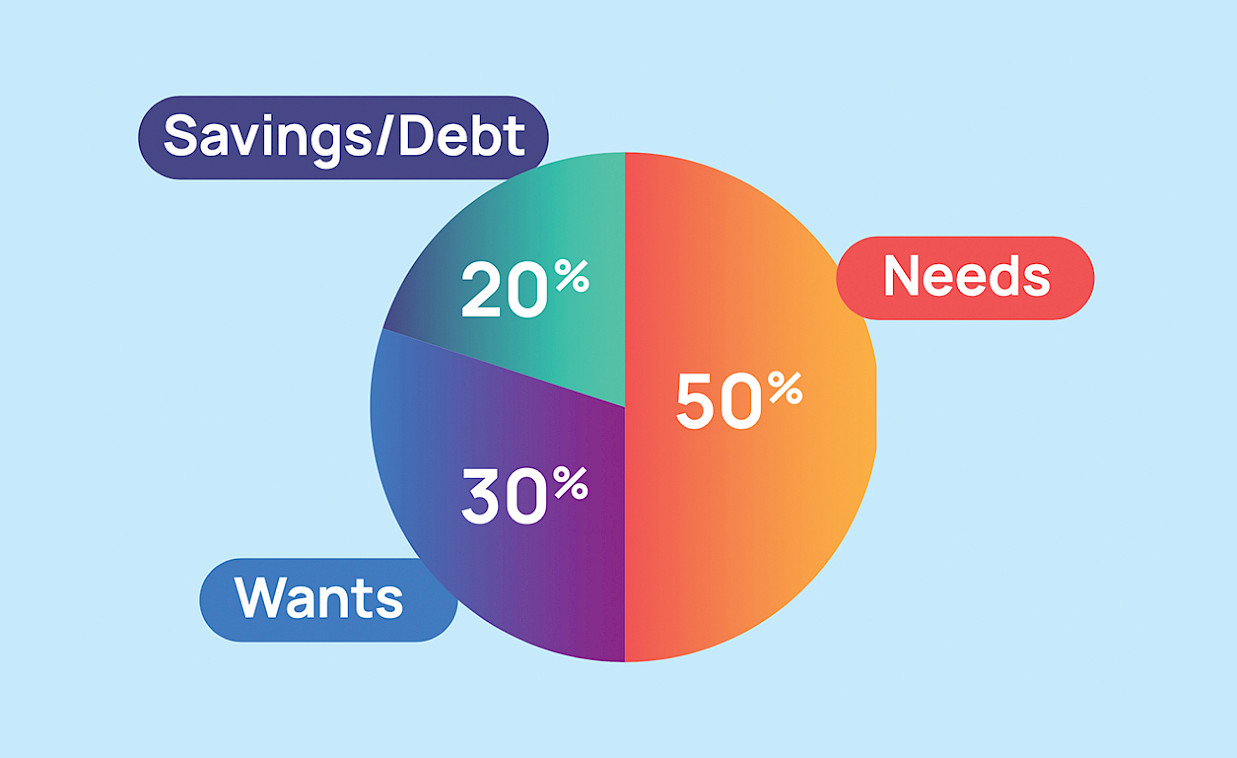

Percentage Budgeting (e.g., 50/30/20 Rule): A popular guideline suggests allocating income towards Needs (50%), Wants (30%), and Savings/Debt (20%). For gig workers, this rule can be applied to each payment received. When money comes in, immediately allocate percentages to essential bills, miscellaneous spending, and savings goals.

Zero-Based Budgeting: This method requires assigning every single shilling of income a specific purpose, rent, food, transport, savings goal, debt payment, etc, until the entire amount is allocated. It forces intentionality.

Budgeting Based on Lowest Expected Income: Estimate the lowest likely monthly income based on past tracking. Create a core budget covering essential expenses based on this figure. Any income earned above this baseline is then channelled directly into savings, debt repayment, or building buffers.

To help you on this journey, here are some effective planning and top free personal finance tools for 2025.

- Prioritise the Emergency Fund: For workers without sick pay or job security, an emergency fund is non-negotiable. This fund should ideally cover 3 to 6 months of essential living expenses (rent, food, utilities, basic transport). Building it takes time. Start small, allocating a portion of your income. This cushion prevents unexpected events from derailing long-term financial goals or forcing reliance on expensive debt.

- Leverage the Peaks: Income tracking will reveal higher-earning periods. During these “feast” times, it is crucial to resist lifestyle inflation and instead consciously allocate a significantly larger portion of income towards savings goals, particularly building the emergency fund or paying down debt.

- Compounding Money Safely: For funds needed in the short-to-medium term, keeping large amounts of cash at home is risky and loses value to inflation. Instead, “park” this money in safe, easily accessible, interest-earning options. The goal is capital preservation with a return, keeping the funds liquid enough for their intended purpose. Linking these strategies to specific goals is vital. Defining clear, tangible goals makes the abstract act of saving more purposeful and motivating, shifting behaviour from simply coping towards proactively building a desired future. An NSSF Smartlife Flexi account can help gig workers start saving from as low as UGX 5,000 towards clearly defined goals, with competitive returns and easy mobile money deposit options.

The journey from hustle to financial security requires commitment. Start small, leverage the digital tools at your fingertips, stay consistent, and seek out financial knowledge. NSSF Uganda has a robust Financial Literacy program, which is accessible at no extra cost. Supported by a growing ecosystem that includes initiatives promoting financial literacy from institutions like the Bank of Uganda, Ugandan gig workers have the means to take control of their finances and build a more secure and prosperous future.