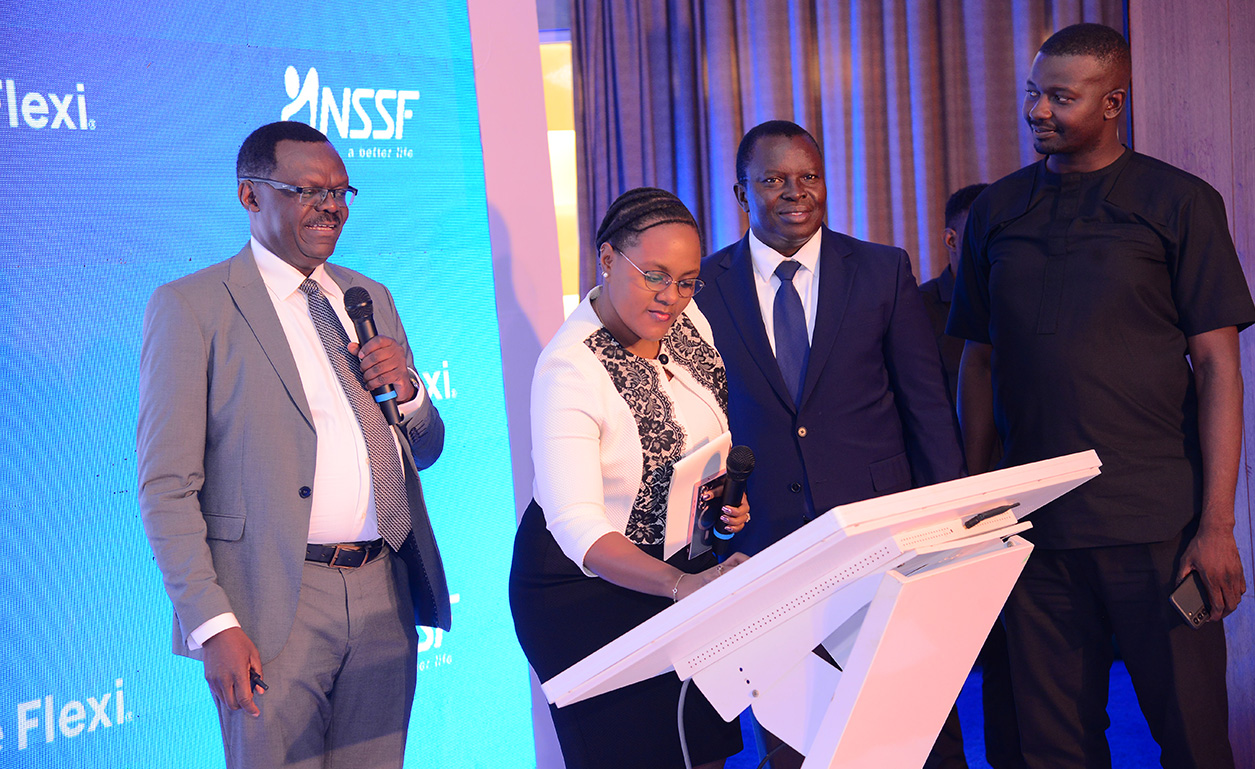

Betty Nambalirwa’s Journey to Financial Security

Tell us a little bit about who you are.

I am Betty Nambalirwa, a 65-year-old retired woman. I am married and blessed with children and grandchildren. My life has been shaped by a commitment to careful planning and a desire to ensure a stable and secure future for myself and my family.

What motivated you to use the NSSF Voluntary Savings Plan for your retirement fund?

When I retired, I received my NSSF savings to work on my rental properties. This project was central to my retirement goals, as rentals would provide a consistent income stream even in old age. The NSSF Voluntary Savings Plan helped me at that time because it supplemented on my savings and helped me top up to complete my rentals. It offered a practical way to build and supplement my savings, enabling me to meet these goals without undue financial strain.

How did you set your financial goals for retirement, and how has the plan helped you achieve them?

Growing up, my mother owned rental properties, which she used to support our family. This inspired me to pursue a similar path. I dreamed of owning rentals, recognizing that they would offer financial independence and stability, even during times when I could not be actively involved. The NSSF Voluntary Savings Plan was instrumental in turning this dream into reality. It allowed me to save consistently, ensuring that I had the funds needed to complete my rental project. Today, the income from these properties provides for my daily needs and gives me peace of mind in retirement.

What specific steps did you take to enroll in the NSSF Voluntary Savings Plan?

A friend who used to work at NSSF introduced me to the scheme and connected me with a Relationship Manager who guided me through the enrollment process. The experience was smooth and informative. Since then, I have referred several friends to the plan, many of whom have also joined and are now benefiting from it.

How did you decide on the amount to save regularly, and did you adjust this amount over time?

Initially, I planned to save UGX 100,000 per month. However, financial challenges occasionally made it difficult to maintain this amount consistently. In such instances, the plan’s flexibility allowed me to adjust my contributions based on my financial situation at the time. This adaptability ensured that I could stay on track without feeling overwhelmed.

What challenges did you face while building your retirement fund, and how did you overcome them?

One of the biggest challenges was dealing with inevitable financial responsibilities, often involving third parties. These demands made it difficult to prioritize saving at times. The key to overcoming this was careful budgeting and prioritization. While it wasn’t always easy, I learned to focus on my long-term goals and make adjustments where necessary.

How does the NSSF Voluntary Savings Plan compare to other savings or investment options you considered?

The NSSF Voluntary Savings Plan stands out for its unparalleled flexibility. Unlike many other options, it does not impose rigid timelines or penalties for irregular contributions. This makes it an ideal choice for retirees and individuals in informal employment who may have fluctuating incomes. Additionally, the plan offers a secure way to grow savings without the risks often associated with other investments.

What strategies did you use to stay consistent and disciplined in contributing to your retirement fund?

Sticking to a budget was my primary strategy. Even when unexpected challenges, such as health issues, arose, I tried to maintain a disciplined approach to saving. The ability to adjust contributions during tough times also helped me stay consistent in the long run.

How has the NSSF Voluntary Savings Plan provided financial security or benefits you didn’t expect?

The plan’s tax-free interest and risk-free nature were significant benefits. Unlike other investment options, I didn’t have to worry about market fluctuations or operational challenges. Additionally, the process of withdrawing funds was straightforward. This level of convenience and security exceeded my expectations, making the plan an invaluable part of my financial strategy.

What advice would you give someone just starting to build their retirement fund using this plan?

The most important step is to get started. The NSSF Voluntary Savings Plan offers unparalleled flexibility, allowing you to save any amount at any time. This means that even small contributions can grow significantly over time, thanks to compounding interest. My advice is to set clear financial goals and begin contributing as soon as possible. With consistency and determination, the plan can help you achieve your dreams.

Looking back, what key lessons have you learned about retirement planning through the NSSF Voluntary Savings Plan?

One of the key lessons I’ve learned is the importance of flexibility. The NSSF Voluntary Savings Plan doesn’t pressure you to save a fixed amount regularly, which is especially helpful when facing financial challenges. Withdrawals are quick and straightforward, making it ideal for retirees or those in informal employment. Above all, I’ve learned that disciplined saving, coupled with a reliable plan, is the foundation of financial independence and peace of mind.

Any last word?

My journey with the NSSF Voluntary Savings Plan has been transformative. It’s not just a savings plan—it’s a pathway to realizing dreams, weathering life’s uncertainties, and achieving financial independence. To anyone contemplating it, my message is clear - take that step. Your future self will thank you.